Acquisition of financial assets and external financing in Germany in the fourth quarter of 2023 Results of the financial accounts by sector

Increase in households’ financial assets, mainly due to valuation gains

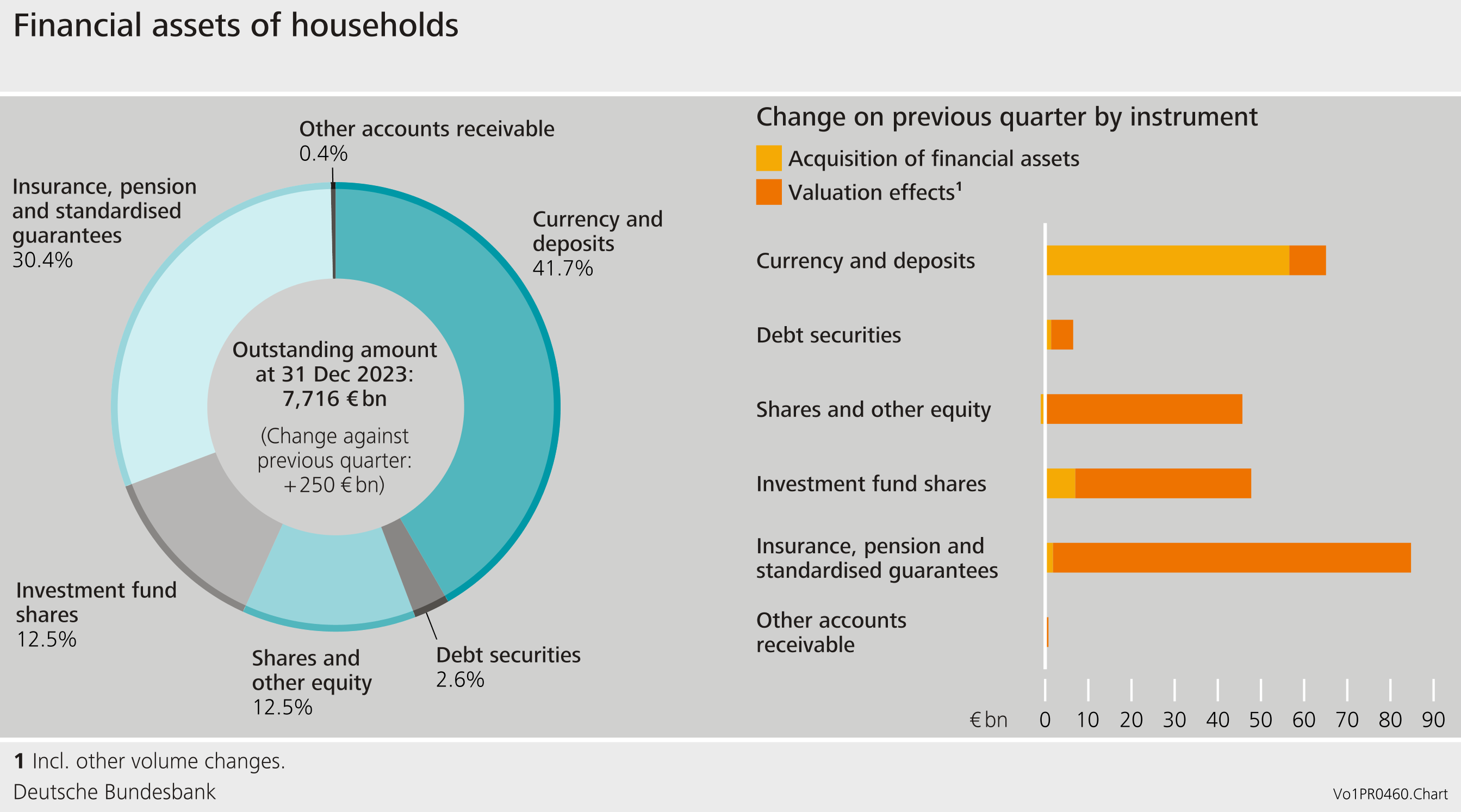

Following the decline in the previous quarter, households’ financial assets rose by €250 billion in the fourth quarter of 2023, amounting to €7,716 billion at the end of the year. This growth was driven by two factors: first, by considerable valuation gains on listed shares, investment fund shares and insurance and pension claims, and second, by households building up their longer-term deposits.

The reporting quarter was characterised by a marked reluctance to purchase and sell most assets. Deposits were the only assets to see growth. In the wake of increased interest rates, households reduced their sight deposits for the fourth time in succession, this time by €19 billion. At the same time, they also increased their higher-interest-bearing longer-term deposits, including savings deposits and savings bonds in this quarter (+€27 billion). Savings bonds and savings deposits have been on strongly divergent trajectories since the third quarter of 2022 – while purchases of savings bonds are being stepped up significantly, savings deposits are being scaled back. Households thus primarily purchased higher-interest-bearing longer-term deposits. Unlike in the previous quarter, households made hardly any purchases of debt securities (+€1 billion) – not even in the form of government bonds. Shares and other equity were reduced overall on balance (-€1 billion).

Households were the beneficiaries of valuation gains totalling €184 billion, €83 billion of which was accounted for by insurance and pension claims alone. Listed shares and investment fund shares also increased significantly in value (+340 billion and +€41 billion, respectively). The market value of debt securities rose by €5 billion.

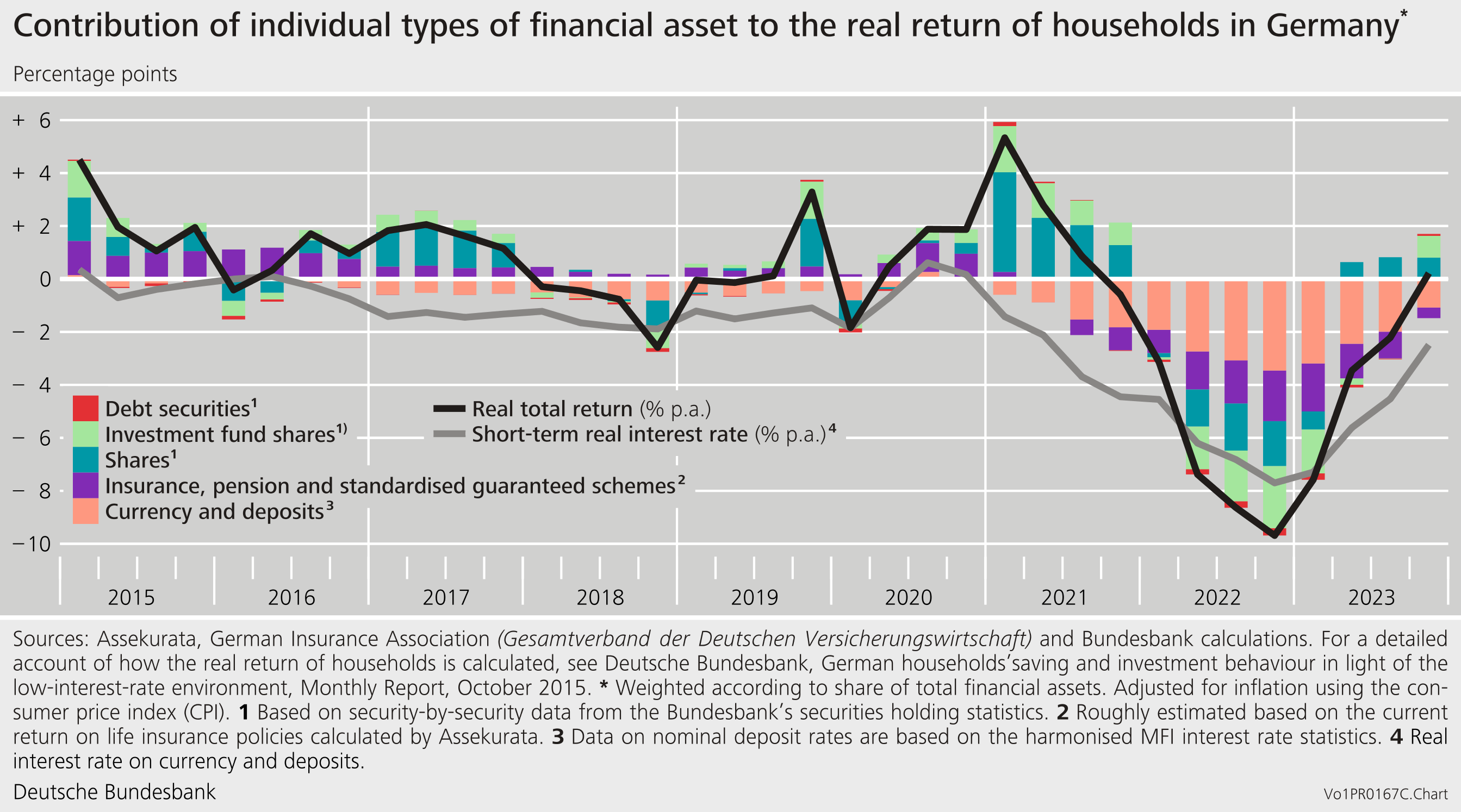

Positive real total return on financial assets for the first time since 2021

The real total return, i.e. adjusted for inflation, on households’ financial assets represents the actual return on financial assets for households. Its computation is based on the period-specific asset structure. Following eight quarters of negative total returns, a slightly positive total return was generated in the fourth quarter of 2023. Moreover, the trend has been rising since the beginning of 2023, thanks in part to the positive annual contribution from shares. As in the previous quarter, the real total return was above the short-term real interest rate.

The structure and volume of households’ liabilities remained largely unchanged in the fourth quarter of 2023. They recorded only a small increase of €5 billion, closing the quarter at €2,155 billion. As in previous quarters, the weak growth in liabilities overall reflects the weak growth in loans for house purchase. The debt ratio declined by 0.6 percentage point to 52.3% as a result of the stronger (nominal) growth in aggregate output.[1] Taken together, households’ net financial assets increased by €244 billion to €5,560 billion in the fourth quarter.

The Bundesbank has recently begun providing additional data on the distribution of households’ wealth. A corresponding use case can be found in the current issue of the Monthly Report.

External financing of non-financial corporations sees slight growth again

Following the very low value recorded in the previous quarter, external financing of non-financial corporations recovered somewhat, reaching €53 billion in the fourth quarter of 2023. Borrowing remained weak at €5 billion, however. Other liabilities were the key driver of growth, amounting to €42 billion.

In annual terms (four-quarter moving sums), the external financing of non-financial corporations was therefore not on the decline for the first time since the third quarter of 2022.

The liabilities of non-financial corporations grew by €113 billion, standing at €8,083 billion at the end of the fourth quarter. This growth is attributable in part to the increase in the value of issued shares and other equity (+€79 billion).

The debt ratio fell from 78.0% to 77.0%. This development, too, is attributable to the nominal growth in aggregate output.[2]

The financial assets of non-financial corporations rose by €54 billion, standing at €6,078 billion at the end of the fourth quarter of 2023. Taken together, non-financial corporations’ net financial assets were down from -€1,947 billion to -€2,005 billion at the quarter’s end.

Owing to interim data revisions of the financial accounts and national accounts, the figures contained in this press release are not directly comparable with those shown in earlier press releases.

Footnotes:

Further information

The Bundesbank has recently begun providing additional data on the distribution of household wealth. A corresponding use case can be found in the current issue of the Monthly Report.

The data on the financial accounts are available at